Kakeibo, a traditional Japanese money saving method, has been helping people manage their finances since the early 1900s.

Originating from a simple yet profound philosophy of mindful spending, Kakeibo encourages individuals to be more intentional with their money.

At its core, Kakeibo is about understanding your financial habits and making conscious decisions to improve them.

Key Takeaways :

- The Origins and Philosophy of Kakeibo

- Understanding the Basic Principles of Kakeibo

- How Kakeibo Differs from Modern Budgeting Techniques

- The Four Key Questions of Kakeibo

- Setting Financial Goals with Kakeibo

- Daily Money Management with Kakeibo

- Kakeibo and Mindful Spending

- Monthly Reflections and Adjustments in Kakeibo

- Kakeibo in the Digital Age: Adapting Traditional Methods

The Origins and Philosophy of Kakeibo

Kakeibo was developed by Hani Motoko, Japan’s first female journalist, as a means to help households manage their finances more effectively.

Its philosophy is grounded in the Japanese values of mindfulness, self-reflection, and the wise use of resources. Kakeibo isn’t just about saving money; it’s about understanding your relationship with money.

Understanding the Basic Principles of Kakeibo

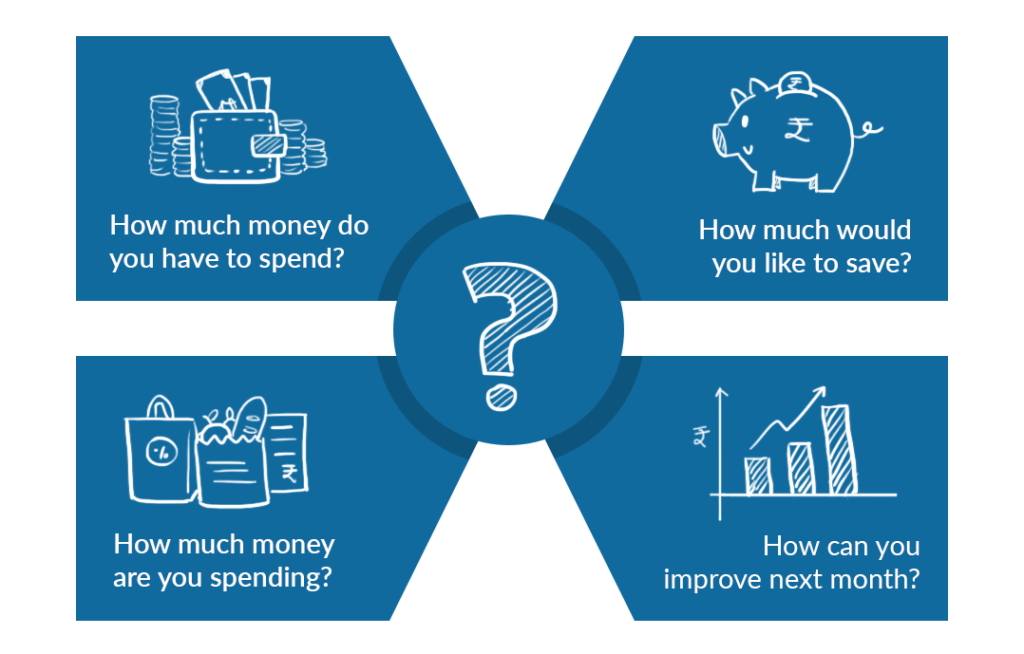

The method is based on four fundamental questions: How much money do you have available? How much would you like to save? How much are you spending? And finally, how can you improve?

By regularly asking yourself these questions, you cultivate a deeper awareness of your financial situation.

How Kakeibo Differs from Modern Budgeting Techniques

In an era dominated by digital tools and apps for budgeting, Kakeibo stands out with its analog approach.

The act of writing down expenses in a notebook is a critical part of the Kakeibo method.

This tactile process fosters a deeper connection and awareness of your spending habits.

a – Comparison with Digital Budgeting Tools

While digital tools offer convenience and automation, Kakeibo emphasizes a more hands-on approach.

The act of physically recording your expenses helps in creating a more personal and impactful understanding of your financial habits.

b – The Psychological Impact of Analog Budgeting

Writing things down has a psychological effect – it makes the information more memorable and gives a sense of accountability.

This is why Kakeibo can be more effective than digital methods for some people, as it engages the user on a deeper level.

The Four Key Questions of Kakeibo

The Kakeibo method revolves around four essential questions that guide your budgeting process.

These questions help in breaking down your financial habits and identifying areas for improvement.

a – Breaking Down the Kakeibo Methodology

- How much money do you have available?

- How much would you like to save?

- How much are you spending?

- How can you improve?

Each of these questions serves a specific purpose and guides you toward a more mindful approach to managing your finances.

b – Practical Examples of Each Question

For instance, by determining how much you want to save, you set a clear financial goal.

Tracking your expenses shows you where your money is going, and reflecting on how you can improve helps in making more informed financial decisions in the future.

Setting Financial Goals with Kakeibo

Setting goals is a crucial part of the Kakeibo method. It involves identifying what you want to achieve with your finances, whether it’s saving for a vacation, building an emergency fund, or simply reducing debt.

a – Short-Term vs. Long-Term Goal Setting

Kakeibo encourages both short-term and long-term financial goals.

Short-term goals might include saving for a special event or purchase, while long-term goals focus on larger objectives like retirement savings or paying off a mortgage.

b – Realistic and Achievable Financial Targets

The key to successful goal setting with Kakeibo is to be realistic and achievable.

Overambitious goals can be demotivating, while achievable targets encourage continuous progress.

Daily Money Management with Kakeibo

Day-to-day management of your finances is an integral part of Kakeibo.

It involves tracking every expense, no matter how small, to get a clear picture of where your money is going.

a – The Role of Daily Expense Tracking

Daily tracking helps in identifying spending patterns and areas where you might be able to cut back.

It’s about being conscious of every purchase and understanding its impact on your overall financial health.

b – Tips for Effective Daily Money Management

Some effective tips for daily money management include categorizing expenses, setting daily or weekly spending limits, and regularly reviewing your spending against your goals.

Kakeibo and Mindful Spending

Mindful spending is at the heart of Kakeibo. It’s about making thoughtful choices with your money, understanding the difference between wants and needs, and recognizing the emotional triggers that lead to unnecessary spending.

a – How Mindfulness Intersects with Spending

Mindfulness in spending means being fully aware of the impact of each purchase on your financial goals.

It’s about pausing and reflecting before purchasing to determine if it aligns with your financial objectives.

b – Strategies for Reducing Unnecessary Expenses

Strategies include waiting before making a purchase, differentiating between essential and non-essential items, and finding joy in saving rather than only spending.

Monthly Reflections and Adjustments in Kakeibo

At the end of each month, Kakeibo encourages a period of reflection. This involves looking back at your spending, comparing it to your goals, and making necessary adjustments for the following month.

a – Analyzing Monthly Spending Patterns

This analysis helps in identifying trends in your spending, understanding what worked well, and pinpointing areas where you can improve.

b – Making Adjustments for Future Savings

Based on this reflection, you can adjust your spending habits, set new goals, or redefine your strategies for achieving your financial objectives.

Kakeibo in the Digital Age: Adapting Traditional Methods

While Kakeibo is traditionally an analog method, it can be adapted to fit the modern, digital world.

This involves finding a balance between the mindfulness of the analog process and the convenience of digital tools.

a – Integrating Kakeibo with Digital Tools

For those who prefer digital methods, there are ways to integrate Kakeibo principles into digital budgeting apps and spreadsheets.

The key is to maintain the essence of mindfulness and intentional spending.

b – Balancing Tradition and Modern Convenience

Balancing tradition and modern convenience means finding a method that works best for you, whether it’s sticking to a physical notebook or using a digital app, but keeping the core principles of Kakeibo at heart.